| Bedford Corners NY Weekly Real Estate Report | 11/25/2013 | |

| Homes for sale | 39 | |

| Median Ask Price | $1,465,000.00 | |

| Low Price | $495,000.00 | |

| High Price | $12,000,000.00 | |

| Average Size | 5059 | |

| Average Price/foot | $467.00 | |

| Average DOM | 194 | |

| Average Ask Price | $2,614,154.00 | |

Monthly Archives: November 2013

Faucets at $1,000 Abound as Home Equity Spigot Opens | Cross River Real Estate

A year ago, New Jersey contractor Michael Mroz’s customers were focused on saving money when renovating kitchens and baths, he said. Now, with a resurgence of home equity lending, they’re ready to pay for the best.

“People don’t want granite countertops — they want marble costing at least 25 percent more,” said Mroz, owner of Michael Robert Construction in Westfield, an affluent town less than an hour’s commute to Manhattan. “Money is so cheap today, people can splurge on $1,000 faucets.”

Spending on home renovations is rising to records as banks such as Wells Fargo & Co. and JPMorgan Chase & Co. (JPM) increase lending for home equity lines of credit, or Helocs, after property prices this year gained at a pace not seen since the last housing boom. Heloc originations could rise 16 percent this year and reach another five-year high in 2014, according to Mustafa Akcay, an economist for Moody’s Analytics, powering the earnings of Home Depot Inc. (HD) and boosting the economic expansion.

Helocs are making a comeback as the housing market recovers enough to make the junior mortgages a safer bet for banks more than seven years after the beginning of the housing crash that saddled them with billions of dollars of losses. The median price for an existing home probably will gain 11 percent this year, according to the Mortgage Bankers Association in Washington, after plunging about 33 percent during the crash.

‘Enormous Impact’

“The biggest use of Helocs is renovations, and the biggest spur for renovations is Helocs,” said Kermit Baker, director of Harvard University’s Remodeling Futures program in Cambridge, Massachusetts. “When the two fuel each other, it has an enormous impact on the economy.”

After home prices began rising in 2012, the number of Americans with negative home equity — those who owe more on their properties than they are worth — began tumbling. At the beginning of last year, that was the case with almost 16 million home loans. By the third quarter of this year, that number had dropped to 10.8 million, property data firm Zillow Inc. said in a report last week.

“There is an increase in the amount people are willing to spend on their homes as the values go up,” said Joe Emison, chief technology officer at BuildFax, a real estate data company. “A lot of them feel in a better position today as the job market and the economy has improved.”

Bank Holdings

Helocs typically are held by banks in their mortgage portfolios rather than being sold in the secondary market to be securitized by Fannie Mae or Freddie Mac, common for primary home loans, said Keith Gumbinger, vice president of HSH.com, a mortgage data firm in Riverdale, New Jersey.

http://www.bloomberg.com/news/2013-11-25/

20 tips to harden your home security for next to nothing | Chappaqua NY Real Estate

Most burglars work the daytime shift, just like most of us do. “Daylight jobs require a burglar to be quick, typically spending around 45 minutes selecting a home to target and just three minutes actually doing the job,” Los Angeles security expert Chris McGoey tells MSN Real Estate.

Burglars decide whether to hit your home based on appearances: Is it easy to crack or not worth the trouble? The most effective improvements are the ones that convince a burglar to move on to the next guy’s home. How? see it here. Sonitrol verified electronic security, this company for commercial security systems in New England notes. Alarm New England’s home security systems in Boston provide multiple safety and home automation features, For more information you could check here. The locksmith walnut creek ca provide locksmith services such as: lock & key cutting, lost car keys replacement, re key and unlock door assistance. Sonitrol provides security systems like Intrusion detection, fire protection, video surveillance and access control.

- Enlist local police. Local police departments typically will send a trained officer to your home to do a “walk through” with you, pointing out your vulnerabilities and suggesting simple fixes. Check your police department’s website for crime statistics and tips. Any resident who lives in Norwalk would do well to protect themselves, by resorting to security systems that will help prevent crimes or at least help pinpoint and catch perpetrators when they do occur, for more information contact Mammoth Security Inc. For example, here is the Los Angeles Police Department’s detailed list of home-security tips for residents. Remember to alert police when you’ll be out of town.

- Chat up the neighbors. Join the local Neighborhood Watch program or start one. Chatting with neighbors updates you on local crime problems and enlists allies who’ll watch your home while you’re away. Neighbors are terrific watchdogs. My retired neighbor up the hill who likes peering out his window through a giant telescope spotted and chased a pre-dawn intruder from my garden once.

- Use your locks. Even if your neighborhood feels safe, make locking up a habit. Burglars often test a home by knocking on a door and, if no one answers, opening it. Keep every exterior door and window locked, including the door between the garage and house. If you need help finding locksmith companies working in Philly willing to take your job.

- Fake it. Getting a dog is a great security move. But if you can’t, pretend to have one, McGoey advises. Buy a couple “Beware of Dog” signs at a hardware store and put them up. When a stranger is at the door, make a show of putting the “dog” in the other room before you open the door.

- Install Long Distance Wireless Security Cameras. That way you will not only get indoor but also outdoor protection, using wireless technology avoid the use of communication wires and it will make your security cameras almost invisible at night time. For more details about security camera, click here now to find out the solution for camera installation.

- Paste a local security company’s sticker on your front window.

- Keep the place looking lived in. Rotate lights on timers when you’re gone. Sign up for USPS’ Hold Mail service, reschedule expected deliveries and get friends to drop by randomly to water plants or just walk around.

- Trim shrubs. Bushy trees and shrubs provide cover for bad deeds. Keep the foliage well-trimmed.

- Use your head. “Don’t open the door — and don’t let kids open the door — to uninvited strangers,” McGoey tells MSN Real Estate. Stay home when workers are in or around your home. Don’t put keys in obvious places like fake rocks and under pots and doormats. “Train children (especially teens) to keep key locations, alarm codes and other family security information private from their friends,” the article adds.Locksmith sacramento ca provide us a good security solution.

- Light the night. Install bright, motion-triggered security lights outside the front and back of your home. Battery-powered lights start at around $10 each. Hard-wired products start at around $50.

- Replace the door … or don’t. The best entry doors are solid wood ($100 and up) or 16-gauge minimum steel ($120 and up), says the Los Angeles Police Department. Use non-removable hinge pins and avoid doors with glass windows unless the glass is burglar-resistant. Consumer Reports’ test of entry doors found, however, that a strong door frame may count more than the door: “All [doors] eventually failed because the doorjamb split near the lock’s strike plate, though we also found that beefed-up locks and strike plates can greatly increase a door’s kick-in resistance.”

- Install a high-quality deadbolt – or two. Whatever you do, don’t rely on a simple knob lock (built into the door handle) alone. Install a deadbolt above a knob lock. McGoey recommends:

- Use a solid core or metal door for all entrance points.

- Use a quality, heavy-duty deadbolt lock with a 1-inch throw bolt.

Pending Sales of U.S. Existing Homes Drop for Fifth Month | North Salem Real Estate

The number of contracts Americans signed to buy previously-owned homes unexpectedly fell in October for a fifth consecutive month amid higher borrowing costs that are denting the real-estate recovery.

The gauge of pending home sales decreased 0.6 percent after a 4.6 percent drop in September, the National Association of Realtors said today in Washington. The median projection in a Bloomberg survey of economists called for a 1 percent gain in the index from the month before.

Higher mortgage rates and price increases driven by a tighter supply of homes for sale may be keeping some prospective buyers out of the real-estate arena. Further gains in hiring and confidence would help boost the housing-market recovery as well as the U.S. economic expansion.

“When mortgage rates went up, people got spooked and rushed into the market to seal deals,” Patrick Newport, an economist at IHS Global Insight in Lexington, Massachusetts, said before the report. “The numbers that we’re seeing for pending home sales are payback for the stronger numbers earlier this year.”

Estimates in the Bloomberg survey of 39 economists for pending home sales ranged from a decline of 2.5 percent to an advance of 3.5 percent.

The NAR’s report showed purchases decreased 2.2 percent from the year prior on an unadjusted basis.

The pending sales index was 102.1 on a seasonally-adjusted basis, the lowest this year. A reading of 100 corresponds to the average level of contract activity in 2001, or “historically healthy” home-buying traffic, according to the NAR.

Facing Headwinds

“We could rebound a bit from this level, but still face the headwinds of limited inventory and falling affordability conditions,” the group’s chief economist Lawrence Yun said in a statement. “Job creation and a slight dialing down from current stringent mortgage underwriting standards going into 2014 can help offset the headwind factors.”

Two of four regions showed a decrease from the September figures, led by a 4.1 percent slump in the West. Pending sales also declined in the South and rose in the Northeast and Midwest.

Existing-home sales are expected to reach about 5.1 million this year and be little changed in 2014, the group said. Purchases weakened in October to a 5.12 million annual rate, the fewest since June, the NAR reported last week. About 4.7 million previously-owned homes were sold in 2012.

Pending Home Sales Continue To Tumble | Bedford Hills Real Estate

Pending home sales fell 0.6% month-over-month in October. This was worse than expectations for a 1% rise.

Meanwhile, pending home sales were down 2.2% on the year, worse than expectations for a 1.1% fall.

Last month’s number was revised up to show a 4.6% fall, compared to an initial reading of a 5.6% monthly fall.

Year-over-year the index was revised up to show a 2% rise, compared with an initial reading of a 1.1% rise.

“The government shutdown in the first half of last month sidelined some potential buyers,” Lawrence Yun, NAR chief economist said in a press release. “In a survey, 17 percent of Realtors reported delays in October, mostly from waiting for IRS income verification for mortgage approval.”

Limited inventory and declining affordability can continue to weigh on the index. Yun thinks the housing recovery is still at a healthy pace and attributes the decline in pending home sales to a cooling down of run up we had seen in housing recently.

Here’s a look at the regional breakdown:

- In the Northeast, the pending home sales index (PHSI) up 2.8% on the month, and is up 8.1% from a year ago.

- In the Midwest, the index is up 1.2% on the month and up 3.2% from a year ago.

- In the South, the index fell 0.8% on the month, and is down 1.5% from a year ago.

- In the West, it is down 4.1% on the month and 12.1% from a year ago.

Pending home sales have been falling for some time now and the index is considered to be a leading indicator for future existing home sales. The Commerce Department expects that 80% of signings will become existing home sales transactions within two months.

http://finance.yahoo.com/news/comes-pending-home-sales-144016650.html

Gramercy Unit Sells for $17.3M; Transplants Can’t Cut it in City | South Salem NY Homes

Welcome to It Happened One Weekend, our weekly roundup of The New York Times real estate section…

1)Big Ticket The award for biggest sale of the week goes to 18 Gramercy Park South, where a full-floor, 4,207-square-foot apartment sold for $17.3 million. Carrying costs rounded out at about $11,225.31 and the sponsors, Zeckendorf Development and Global Holdings, bestowed a key to the private Gramercy Park as a customary closing gift, which sounds wonderfully dramatic and fun. We wish we had a key to a secret park . . . [“Big Ticket | Luxury Lodging for $17.3 Million”]

2) Every “The Hunt” column begins with the Hunters describing the apartment they want, and ends with them rationalizing whatever they came away with. This is The Hunt: Dreams vs. Reality The Hunters: a couple sick of city-life looking to move to the ‘burbs Price Dream: $350,000 to $450,000 Reality: $387,500 Neighborhood Dream: Westchester Reality: Hartsdale Amenities Dream: quiet, spacious Reality: 3BR/2BA, spacious Summary After seeing their rent on the Upper East Side skyrocket, this couple decided that city-life (and its modern hullaballoo!) wasn’t for them and decided to look for a two-story home in the suburbs, focusing on Westchester. They eventually settled on a two-story, Cape-style home with three beds and two baths in Hartsdale, attracted by its small ask and spaciousness. They paid $387,500 and are apparently loving life because everything’s cheaper and commuting to work doesn’t make them homicidal. But alas, they now live in the suburbs, trading crippling neurosis for soul-shattering boredom.

[The Hunt/”In Westchester, an End to Elevator and Subway Commutes”]

Ex-Deputy Mayor’s Upper West Side Townhouse Asks $13M | Bedford NY Real Estate

Dan Doctoroff isn’t a name you hear all that often, but in his role as one of Bloomberg’s deputy mayors from 2001 to 2007, he oversaw the development of some of the city’s most high-profile projects, including the World Trade Center, Atlantic Yards, Governor’s Island, the High Line, and Brooklyn Bridge Park. Now, he’s selling his Upper West Side townhouse and asking an impressive $13 million. The 25′-wide, five-floor limestone mansion was built in 1896 by Clarence True, architect of the landmarked Leech House. Doctoroff and his wife bought the place out of foreclosure for $1 million way back in 1994 and spent millions on a full gut renovation. A “low stoop” townhouse, it features big wrought-iron doors at street-level, plus a formal dining room with high ceilings, floor-to-ceiling bay windows in the living room, a wet bar, gas and wood-burning fireplaces, and a fully landscaped garden. New amenities include an elevator, central air, and a finished basement with a gym.

http://ny.curbed.com/archives/2013/11/23/

Facebook is for grandparents | Waccabuc NY Realtor

It’s time to move on. The feeling is becoming more and more significant with each passing day and it just keeps spreading.

It’s just not it any more… we want something new, exciting, which can take us places we’ve never been. We want to be surprised again. We want a new, better social network.

Facebook may say its user base is growing, but original members from the last decade appear to be leaving in droves. As more niche networking services and platforms enter the space, people are finding that not any one company is serving all of their networking needs. Our tastes and channels are becoming fragmented, and users are pushing back on accepted norms in the social media space.

This is inevitable. It’s a natural life cycle for any product; unless it somehow becomes a living organism with its own reproductive system and evolution, one will eventually wither and die. Facebook cannot evade this process – it regenerates with nuances, but is not reinventing itself.

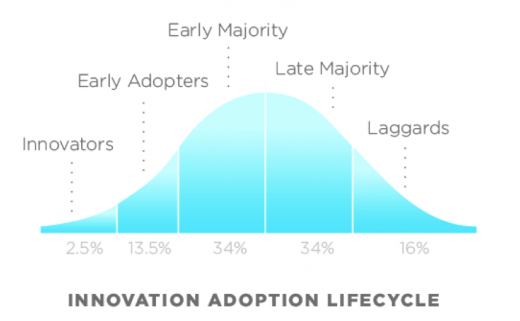

For inventions, it usually looks like this:

Early adopters as shown in the Rogers’ bell curve

This curve is missing something important – the two-way migration that happens over time. When the late majority joins in, the innovators and early adopters are already feeling uncomfortable.

Facebook today doesn’t resemble a thriving, living metropolis – it’s more of a friendly neighborhood bar. For that reason, FB will face its cruel destiny of simply fading away. Living in the same city as your parents is forgiven and acceptable; there is enough diversity and distance between everyone. But finding yourself sitting in the same bar as your mom and dad – that’s horrifying. When your father posts pictures of sunsets and breakfast on his wall you know it’s over.

The conclusion is undeniable; a new social network is needed. These are the things that will make it awesome and sustainable…

Genworth Mortgage Insurance will offer discounts on ‘green’ homes | Bedford Corners Real Estate

Mortgage insurers have statistical evidence that people who buy homes with energy-saving components present a lower risk of default, and Genworth Mortgage Insurance is determined to reward those homeowners by incorporating that knowledge into its underwriting procedures, syndicated housing columnist Ken Harney reports.

Genworth already offers Canadian buyers a 10 percent “energy-efficient refund” on their premiums, and more leeway on debt-to-income ratio calculations used in underwriting.

On a $300,000 mortgage with a 5 percent down payment, Canadian homeowners can qualify for an $825 refund, and have savings on heating bills factored into debt service ratios. Source: courant.com.

– See more at: http://www.inman.com/wire/genworth-mortgage-insurance-will-offer-discounts-to-owners-of-green-homes/#sthash.6DOcnD4E.dpuf

Good news for California homeowners facing short sales | Mount Kisco Real Estate

Under regular tax rules, when a lender forgives a debt — that is, relieves the borrower from having to pay it back — the amount of the debt is taxable income to the borrower.

A homeowner who has $100,000 in mortgage debt forgiven through a short sale, for example, would have to pay income tax on the $100,000.

This “cancellation of indebtedness” rule could have caused enormous financial hardship to the millions of homeowners whose homes were “underwater” during the home foreclosure crisis that began in 2007. To prevent this, Congress enacted the Mortgage Forgiveness Debt Relief Act of 2007.

This law allowed homeowners to exclude from their taxable income up to $2 million of debt forgiven on their principal residence by a lender in a short sale, mortgage restructuring, or forgiven in a foreclosure. This law was never intended to be permanent. It was originally scheduled to expire at the end of 2009.

However, it was extended for an additional four years. It will now expire at the end of 2013. The law could be extended again, but there appears to be little urgency in Congress to do so. That means starting on Jan. 1, 2014, there is a good chance that the old rules on forgiveness of home loan debt will come back into force.

See more at: http://www.inman.com/2013/11/25/good-news-for-california-homeowners-facing-short-sales/#sthash.WbCTNyDm.dpuf