Astorino Proposes 2014 Westchester Budget With No Tax Increases | The White Plains Daily Voice.

Tag Archives: Mount Kisco NY

DIY Garden Lights | Mount Kisco Homes

Reuse plastic bottles to make these easy, elegant DIY garden lights that cost almost nothing.

After you’ve gathered the materials and tools, it takes only about 10 minutes to put together this garden light for your property.

Step 1: What You Need

Materials and tools you’ll need to make one DIY garden light:

- One plastic bottle (A translucent bottle works well; you can reuse plastic bottles that originally held laundry detergent or fabric softener.)

- One old bicycle inner tube, or at least 6 rings cut from an inner tube

- One broomstick, as long as you prefer

- Pair of scissors

- Small hacksaw

- Tea light (small candle in an aluminum container)

Step 2: Sawing

Use the hacksaw to cut off the bottom of the plastic bottle as well as a thin slice off the top of the cap.

Step 3: Quarters

Make four long cuts with the scissors along the corners of the plastic bottle.

Step 4: Petals

Shape the four parts from Step 3 into leaves by trimming off the rounded corners.

Step 5: Cap Adjustment

Unscrew the cap from the plastic bottle. If there’s an inner ring on the bottom of the cap, remove it with the hacksaw. The goal is to make the cap flat — and open — on the underside.

Step 6: Big Match

Cut six rings from the bicycle inner tube. Pull the rubber rings over the end of the broomstick, one at a time, so that they cover each other and form a layered gasket. Make sure the broomstick’s end has been built up with enough rubber layers so that the bottle cap can be pushed on only with some effort. You may need to cut more rubber rings if the seal is too loose.

Read more: http://www.motherearthnews.com/diy/plastic-bottle-garden-lights-zboz1309ztri.aspx#ixzz2kiv0ie9F

Bed-Stuy eyed as next Williamsburg | Mt Kisco Realtor

A brokerage firm born 11 years ago in a once coming Brooklyn neighborhood called Williamsburg is opening an outpost in another area where it sees loads of potential, Bedford Stuyvesant.

Aptsandlofts.com recently inked a lease for 2,000 square feet on the ground and second floors at 308 Malcolm X Blvd. between MacDonough and Decatur streets. It will be the broker’s third office in the borough, the second having opened just last year in Cobble Hill.

“I’m seeing in Bed-Stuy what I saw happen in Williamsburg in 2002,” said David Maundrell, founder and president of the firm. “We’ve been working out there for a very long time.”

As low inventory and high costs push more prospective buyers and renters into Bed Stuy, sales transactions have been heating up, according to Mr. Maundrell. For example, he has seen families move into the neighborhood and plunk down $1 million to convert a three-family home into one just for themselves, something that would have been unheard of just a few years ago.

The neighborhood is home to a diverse housing stock, including blocks of brownstones that Mr. Maundrell said are more reminiscent of Cobble Hill, which has also been attracting a steady increase of buyers.

Aptsandlofts.com is far from the only brokerage doing business in Bed Stuy. The city’s biggest residential firms, among them Douglas Elliman, Corcoran, Halstead Property, and Brown Harris Stevens all have numerous Bed Stuy listings. What they don’t have, however, is an office there. Instead, Aptsandlofts will compete head to head in Bed Stuy with a number of smaller home-grown brokerages. Mr. Maundrell said he hopes to offer something in between.

http://www.crainsnewyork.com/article/20131112/REAL_ESTATE/131119972

Hong Kong Luxury Property Prices Choked by Tightening | Mt Kisco Real Estate

Hong Kong businessman Raymond Chiu says he has perfect credit and is prepared to spend about HK$16 million ($2 million) on a 1,000-square-foot apartment in the city’s Mid-Levels residential area. There’s just one catch. The government requires a 50 percent down payment.

That’s “really putting us off,” said Chiu, 45, who owns an information technology consulting company. “I run a business so cash flow is important. It’s frustrating because this is non-negotiable, though I have perfect credit history.”

Prices of high-end apartments, defined as those larger than 1,000 square feet or costing at least HK$10 million, have gained less than the broader market since the second half of 2012 as buyers in Chiu’s price bracket have been hardest hit after the government raised minimum down payments six times over less than three years as part of curbs to make homes more affordable.

The slowing price growth in high-end apartments is the first sign that efforts to temper rampant speculation that has fueled a surging housing market are working even as it stings luxury developers and potential homebuyers. Broker Cushman & Wakefield Inc. forecasts that prices of homes valued at more than HK$10 million will fall about 3 percent in the fourth quarter, extending a 3 percent drop so far this year, while those selling for less will be little changed.

“The luxury segment has taken the first and the most direct hit,” said Buggle Lau, chief analyst at Midland Holdings Ltd., Hong Kong’s biggest realtor by branch numbers. “The measures were aimed at driving the speculators away and they have certainly achieved that, but many people wanting to buy for their own use are also affected.”

World’s Highest

An influx of wealthy buyers from mainland China, mortgage rates close to record lows and a financial-services sector that has thrived thanks to fundraising by Chinese companies helped fuel a 250 percent increase in luxury-home prices from 2003 to the beginning of 2012, outpacing the 150 percent gain in mass-market homes, according to statistics compiled by Savills Plc. The London-based broker defines luxury homes as those with at least 1,000 square feet (93 square meters) or value of at least HK$15 million.

Hong Kong home prices are the world’s highest in a Savills survey of 10 cities, including London, New York and Tokyo. The value of luxury properties will drop as much as 5 percent in the second half after a 3.2 percent decline in the first three months of the year, according to Savills. Prices in the mass market will see no change after increasing 1.7 percent in the first six months, the broker said.

Luxury Projects

Sun Hung Kai Properties Ltd., a developer of luxury residential projects, plans to build more, smaller apartments because of a change in buyers’ appetites, Victor Lui, the company’s deputy managing director, said in September. The company, one of Hong Kong’s two-biggest developers by market value, reported lower profit from sales for the year ended in June.

There were about 86,000 luxury homes — or units of at least 100 square meters (1,076 square feet) — in Hong Kong at the end of 2012, according to statistics from the government. That represents about 7.7 percent of private homes in the city. About 24 percent of the 10,149 new homes completed by developers in 2012 were larger than 100 square meters, government statistics show.

The gap between the top end of the market and the cheaper bracket narrowed last year as the government’s mortgage tightening started to impact the luxury segment. Prices of mass-market homes rose 20 percent in 2012, almost double that of luxury homes, according to Savills. Prices of luxury homes began to decline after the government in October 2012 slapped a 15 percent tax on all non-resident buyers as it sought to stem the inflow of Chinese capital into the property market.

Chinese Buyers

“For a while, Chinese buyers were the main driver for luxury homes,” said Thomas Lam, Hong Kong-based research director at broker Knight Frank LLP. “When you raise buying costs for them, of course it takes away a large part of the demand.”

Mainland Chinese buyers accounted for an estimated 8 percent of private home sales in the city, a former British colony returned to Chinese rule in 1997, in the third quarter of this year, down from a record 25 percent in the fourth quarter of 2011, according to Centaline Property Agency Ltd. Since October 2010, the Hong Kong Monetary Authority, the city’s de-facto central bank, has raised the minimum down payment required for home purchases over HK$10 million to as much as 60 percent from 30 percent, and to 50 percent for those from HK$7 million to HK$10 million. The most recent round took place in February.

Mortgage Rules

That month, the government doubled stamp-duty taxes for all properties over HK$2 million, with new tax rates ranging from 1.5 percent for properties valued below HK$2 million, to 8.5 percent for those priced above HK$21.7 million.

“The extra stamp duties and mortgage rules are like progressive taxes,” said Vincent Cheung, Hong Kong-based national director of valuation at Cushman & Wakefield. “The higher the property value, the higher the tax rates and the tighter the mortgage rules. Of course this would impact luxury properties the most.”

Hong Kong’s government won’t cut back property curbs until there’s a “steady supply” of new housing, Chief Executive Leung Chun-ying said in June.

There were 607 sales of homes worth over HK$12 million in the third quarter, according to statistics compiled by Centaline. The number is the lowest since the first quarter of 2009, according to the Hong Kong-based realtor.

http://www.bloomberg.com/news/2013-11-10/hong-kong-luxury-property-prices-choked-by-tightening.html

Cindrich Set For Another Term As Mayor Tops News This Week | The Mt. Kisco NY Realtor

Joan Rivers squares off again with UES condo squatter | Mt Kisco Real Estate

From left: Joan Rivers and 1 East 62nd Street

Joan Rivers is heading back to court today to try to kick out a troublesome ex-tenant from the Upper East Side condominium where the comedian presides over the building’s board.

In court papers, Rivers maintains that Elizabeth Hazan created a fire hazard at 1 East 62nd Street by using candles to light her unit after refusing to pay her electric bill and illegally entered the building last month. Hazan is a renter; the owner is a Belize-based corporation.

“Accompanied by a gaggle of reporters, (she) attempted to storm the building … forcing police to close down the street … (and) preventing at least one unit owner from leaving the building,” board lawyer Kevin Smith said of Hazan in an affidavit seen by the New York Daily News.

The board has had other legal run-ins with Hazan, a 41-year-old French Canadian. Her attorney, Darius Marzec, told the newspaper that the board’s latest court filing was “a continued bout of harassment.”

Rivers won a favorable ruling against Hazan in October when a New York state judge barred anyone from entering the $2 million home until the owner forked over $200,000 in unpaid fees. [NYDN]

http://therealdeal.com/blog/2013/11/07/joan-rivers-back-to-court-over-ues-condo-squatter/

Mt Kisco NY Weekly Real Estate Report | #RobReportBlog

| Mt Kisco NY Weekly Real Estate Report | 11/6/2013 | |

| Homes for sale | 47 | |

| Median Ask Price | $575,000.00 | |

| Low Price | $225,000.00 | |

| High Price | $3,950,000.00 | |

| Average Size | 2788 | |

| Average Price/foot | $322.00 | |

| Average DOM | 133 | |

| Average Ask Price | $972,195.00 | |

Homes near cemeteries: Do they sell? | Mount Kisco Homes

With Halloween quickly approaching, Redfin was dying to know: Do homes near cemeteries sell for more or less than homes farther away from cemeteries? Would a drop-dead-gorgeous home take longer to sell if the view includes tombstones? Would a home shopper have grave concerns about a home near a cemetery, or would the quiet neighbors be a selling point? We dug into the data to find out.

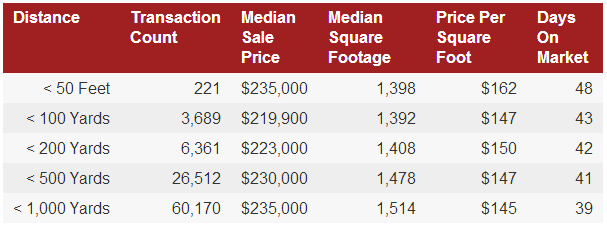

Redfin analyzed the price of homes less than 50 feet from a cemetery and compared those to the price of homes less than 100, 200, 500 and 1,000 yards away. The numbers indicate that on average, homes near cemeteries are slightly smaller, but they sell for more per square foot. On average, homes closest to cemeteries sold for $162 dollars per square foot, whereas the homes located more than 500 yards away sold for $145 per square foot.

“I have a current listing that backs up to a cemetery, and 10 to 15 people have toured the home. One potential buyer provided feedback that it was a deal breaker, but that is just one of many. In my opinion, cemeteries make very quiet neighbors,” said Blakely Minton, a Redfin real estate agent in Philadelphia.

“Like everything with homebuying, there are pros and cons to living near a cemetery. The pros are that most likely there would be no chance of future development on the site of a cemetery, there is usually well-maintained open space, it’s quiet and many cemeteries are picturesque. The cons would be that cemeteries give some people an uneasy feeling, as it represents mortality, and it might not be an area they want to ‘live’ next to everyday,” said Lynn Ikle, a Redfin real estate agent in Baltimore.

The analysis also reveals that homes adjacent to cemeteries take longer to sell on average. Those located less than 50 feet away took 48 days to sell, whereas those located more than 500 yards away took 39 days to sell. Based on the analysis, homes near cemeteries sell for more money, but it may take longer to find the right buyer.

“Having a home right next door to a cemetery may make it more difficult to sell. There will always be a group of people who might love all of the specifications of the house, but the ‘creepy’ factor may prevent them from even touring the home. Having fewer folks tour a home could lead to a home staying on the market longer,” said John Malandrino, a Redfin real estate agent in Chicago.

Not all cities are the same when it comes to the number of cemeteries located within city limits and the number of homes built around them. Redfin evaluated 90 metropolitan areas across the nation to find the five cities with the most homes for sale near cemeteries. The analysis looked at homes for sale as of Oct. 15 that were less than 100 yards from a cemetery. Some of the nation’s oldest cities topped the list:

1. Baltimore

Homes for sale near cemeteries: 172 Median list price of those homes: $101,950

“It doesn’t surprise me that Baltimore tops the list, because it was founded back in the early 1700s,” Ikle said. “Our neighborhoods here are very well-established, and cemeteries were part of the landscape during their development.”

2. Philadelphia

Homes for sale near cemeteries: 157 Median list price of those homes: $134,900

“Since Philadelphia was one of the first major settlements in the U.S., there are cemeteries scattered throughout the city,” Minton said. “I had one friend who moved into a home with a cemetery right behind it. One day, she came home with her hands full of groceries and nearly hit the floor with food flying when she heard a gun shot outside. It turns out that the cemetery was for veterans, and it was a military salute.

“The type and size of cemetery is something to consider when deciding on a home by a cemetery, but in my opinion, the reminder of how precious life can be is a positive, not a negative.”

3. Chicago

Homes for sale near cemeteries: 115 Median list price of those homes: $229,900

“With buildable land at a premium, especially in and around the downtown Chicago area, builders have built and will continue to build in close proximity to cemeteries,” Malandrino said.

4. Boston

Homes for sale near cemeteries: 50 Median list price of those homes: $711,809

“The main reason Boston has so many cemeteries is because it has so many churches. Nearly all of the older churches in the greater Boston area have large cemeteries attached to them. These churches are frequently located in residential neighborhoods, so people could walk to church events,” said Peter Phinney, a Redfin real estate agent in Boston. “Churches were not only the center of worship, as they continue to be, but also the center of cultural events and social gatherings. It was only natural for people to want to be buried in their neighborhood next to the church, so homebuyers in the Boston area have made their peace with having a cemetery nearby. In fact, many welcome having the green space.”

http://realestate.msn.com/blogs/listed-buy.aspx?post=5c37386d-9625-4935-974f-33ed9e917554

Want a Castle? There’s One Being Foreclosed in Virginia! | Mt Kisco Real Estate

Yes, there’s a castle facing foreclosure in Northern Virginia. Try finding that sentence anywhere else this year. But hey, for those who have always wanted to live in royal digs and missed out on this Dupont option, Melrose Castle in Warrenton, VA is asking a mere $1.5 million. To be fair, here are some of the amenities included in the lofty price: eight fireplaces, an inground pool, 50 acres of land, a tennis court and a barn with two paddocks. Most five bedroom “single family homes” do not come with all of that. Plus, it’s a castle! Check out the gallery to see photos of such fairy tale-esque things like the spiral staircases leading to the roof. · 8871 Rogues Road , Warrenton, VA 20187 [Colgan Real Estate]

Real estate sales skyrocket; on cusp of a seller’s market | Mt Kisco Real Estate

It just keeps getting better.

The September real estate figures for the Greater Lehigh Valley show a robust 19.8 percent increase in home sales over September 2012, another strong month in what has been a brisk year of activity.

“This year has been absolutely the best year we have had probably in the last eight years,” said Bill Sands, broker with Sands & Company, Wyo-missing, Berks County. “It has been very robust.

“That robust activity and sales volume we experienced I feel is a direct attribute to the confidence that the market has reached bottom and has stabilized. The interest rates were still at an all-time low, so that has propagated a lot of people to feel safe to venture back into the market.”

The numbers from across the region show that 1,260 homes were sold in September, an increase of 208 homes when compared to last September. And going back two years, this year’s September numbers show a 23.4 percent jump over September 2011’s figures.

Sands sees positive signs for the market, in part because of a reduction in the number of foreclosures.

“In the past, foreclosures were very much as-is,” he said. “With the banks and investors taking back these properties, going in and doing the basic cleanup, they are getting a higher price point, which is helping to raise the bar on the value. It’s a very positive sign.”