Yesterday on Housecall, we discussed ways to increase your home value with indoor décor. Today, we’re focusing on what you can do outside the home to give it an added monetary boost.

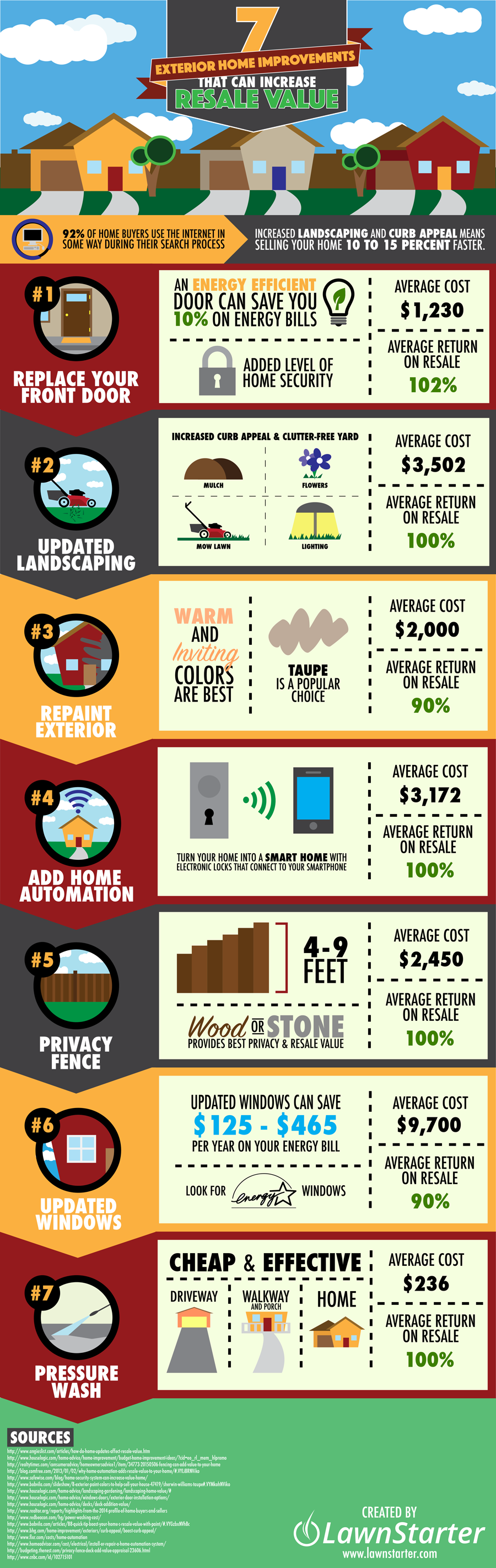

Curb appeal is everything when it comes to selling your home, and that means your home’s exterior needs to be in optimal condition. In fact, 71 percent of prospective home buyers say that a home’s curb appeal is an important factor in their buying decision. This infographic fromLawnStarter shows seven exterior home improvements that can increase resale value and help sell your home even faster:

Replace Your Front Door

Believe it or not, a front door says a lot about you and your home. A quality front door can be a huge asset for your home’s value, and how secure your home feels upon entrance. Kelly Fallis of Remote Stylist says, “It’s the first thing a buyer walks through. Repaint or replace; their first impression rests on it.” According to House Logic, a standard 20-gauge steel door can cost around $1,230, but that investment can more than pay for itself with the amount of value it adds to your home. A quality front door replacement can bring you a return of around 102 percent, which makes it a great bang for your buck.

Updated Landscaping

Over 92 percent of prospective home buyers use the Internet at some point during their search process, meaning a lot of eyes are going to be looking for pictures of your home. You want to be able to showcase your property in the best light possible to drive interested parties in for a closer look. According to Bankrate, a quality landscaping job has the potential to net you a whopping 252 percent return in increased home value. John Harris, a landscape economist, has stated that updated landscaping can increase a home’s value by 28 percent and have it sold 10-15 percent quicker.

New Paint

Most prospective homeowners tend to look at what they need to update or work on in the homes that they look at. Repainting your home can cause less stress on the buyer since they know that the job is fresh and adds to the look of the home. That being said, don’t go overboard with color choices. Choose warm and inviting colors, such as taupe, tan or white. “Individuals too often minimize the impact of a first impression,” says James Alisch, managing director of WOW 1 DAY PAINTING. “The exterior paint job of a home greatly impacts how potential buyers feel about a place.” You want to make sure that potential buyers can envision themselves inside your home, and having a neutral exterior color is appealing to a larger pool of buyers. If you do feel the need to add some brighter colors, make sure that they aren’t overpowering and can work well with the neutral base. It’s best to consult your local home improvement store to discuss your options and budget.

read more…