The lack of affordable housing in New York City and its suburbs could threaten job creation and future economic job growth, according to a new report from the city’s Planning Department.

“The region’s housing supply has not been keeping up with job growth in recent years,” the report said. “This pattern would be expected to heighten affordability challenges and create headwinds to further business growth.”

Released Wednesday, the 32-page report found that New York averaged just 45,800 permits for new apartments and homes per year between 2009 and 2018. That’s down about 30 percent from the period between 2001 and 2008, when the city and its tri-state suburbs averaged 63,600 units per year.

The Central Park Tower, center, is under construction, Tuesday, Sept. 17, 2019 in New York. At 1550 feet (472 meters) the tower is the world’s tallest residential apartment building, according to the developer, Extell Development Co. (AP Photo/Mark L

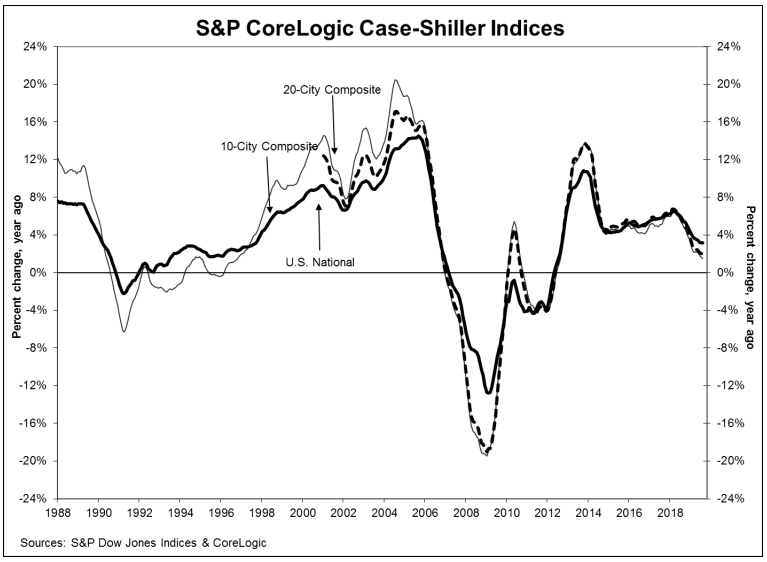

Prior to the financial crisis, the city and its suburbs, including Long Island, Westchester, northern New Jersey and Connecticut, created an average of 2.2 new houses or apartments per new job. But that number has slipped in the decade since the recession as job growth skyrocketed, falling to just 0.5 units added per job.

Over the last 10 years, New York City averaged 20,000 new homes or apartments annually, granting far more housing permits than any of its suburbs.

City Hall said in a statement to the New York Post, which first reported the news, that in 2018, New York issued 22,000 new housing units.

“It’s key that we continue to produce housing at a high pace, and we need our neighbors to do the same if we are going to address regional housing affordability and support economic growth,” City Planning spokeswoman Rachaele Raynoff told the Post.

According to an “Affordability Index” published by Comptroller Scott Stringer, the impacts of expensive housing costs varied across households. Rent swallowed up 37 percent of the average single adult’s earnings, but that figure, at 47 percent, was even higher for single parents. It accounted for 26 percent of married couples’ budgets.

“New York City’s affordability crisis impacts every New Yorker and every community — and the numbers laid out in our affordability index shine a light on this worsening crisis,” Stringer said.

read more…